Congratulations! Signing a contract of sale marks a major milestone in the property buying process in Victoria. While the negotiations are complete, the period between signing and settlement, often several months, is crucial and requires careful action to ensure a smooth transfer of ownership. Understanding what happens after signing a contract of sale in Victoria is paramount.

When Is a Property Contract Legally Binding?

Signing vs exchange

When a buyer signs a contract, it constitutes a written offer to purchase the property. The contract becomes a binding and enforceable agreement once signed by both parties.

Cooling-off period explained

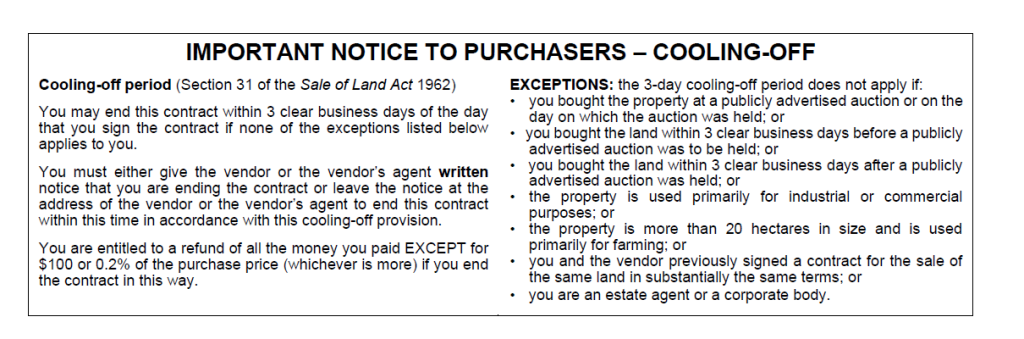

A key aspect after signing a house contract in Victoria is the cooling-off period. In Victoria, a buyer who signs a contract for the sale of residential property has a right to change their mind, or ‘cool off’, under the Section 31 of the Sale of Land Act 1962.

The cooling-off period lasts for three clear business days starting from the day after the buyer signs the contract. This right cannot be removed through a term in the contract of sale.

If a buyer decides to exercise their cooling-off right, they must provide written notice to the seller or their representative. If they withdraw, they must pay a penalty, which is 0.2% or $100 of the purchase price, whichever is greater. The buyer may be entitled to a full refund of any money paid, minus that penalty according to the contract of sale.

However, the cooling-off period does not apply in several circumstances, including:

- On property sold at public auction

- On rural properties larger than 20 hectares

- If the property is used for industrial of commercial purposes

- If the buyer has previously entered into a contract of sale with the seller for the same property on substantially the same terms.

Key Steps After Signing a Contract in Victoria

Once the contract is signed, there are several immediate contract of sale next steps the buyer must take to prepare for settlement.

Paying the deposit

The first step after signing the contract of sale in Victoria is usually to hand over the deposit. The deposit is typically a percentage of the purchase price, often 10%, though this can vary. Before payment, buyers should check that the deposit amount outlined in the contract matches what was agreed upon during negotiations and aligns with their lender’s conditions. The deposit is usually held in the real estate agent’s trust account until settlement, unless early release is permitted.

Finance approval and valuations

Even if you secured home loan pre-approval before searching for property, the time after signing a house contract in Victoria is when you must finalise your financing. You need to let your home loan provider know you have signed the contract and supply them with a copy so they can review critical details like the settlement date and purchase price.

Lenders may request additional documentation, such as bank statements or proof of income, to verify your finances and confirm your ability to service the loan. Crucially, the lender will then conduct a property valuation to determine if the home’s price is in line with its market value before officially approving your finance.

Building and pest inspectionss

While many inspections occur before signing, some essential inspections may take place afterward. Your contract may contain a clause that allows you to conduct a building and pest inspection after signing. If major issues are discovered during this inspection, this clause may allow you to negotiate repairs, adjust the sale price, or even terminate the contract.

A standard and highly recommended step is the pre-settlement final inspection. This final inspection allows you to examine the property one last time before settlement to confirm that any requested repairs have been completed and that the property remains in the same condition as when the contracts were exchanged.

Buyer Obligations After Signing– timeframes buyers must meet and the property buying process in Victoria

As a buyer, you must act quickly to organise the rest of the transaction between signing and settlement.

Finalising finance

You must officially organise finance for the property quickly after the contract is signed.

Fulfill conditions

Any conditions detailed in the contract, such as finance approval or specific inspections, must be fulfilled within the agreed timeframes.

Arrange utilities and insurance

It is recommended to arrange for your utilities, such as electricity, gas, and internet, to be connected on or before the settlement day to ensure a smooth transition without interruption. In Victoria, the risk of damage to the property passes to the buyer at settlement. Buyers should arrange building insurance on or before settlement day.

Risks of missing deadlines

Failing to meet obligations or deadlines can jeopardise the sale. If a finance application fails and the contract includes a finance clause, the clause may protect the buyer by allowing them to rescind the contract and potentially receive a refund of their deposit. Conversely, if a buyer decides to back out of the agreement after signing without a contractual right to do so, the seller may be entitled to keep the deposit as compensation.

Call us if you need assistance with your property conveyancing

- Same-day contract of sale and section 32 review

- Expert advice by qualified property lawyers

Special Offer: $50 Discount on your first contract of sale and section 32 review

(valid until 28 February 2026)

Seller Obligations After Contract Signing

Title and document preparation

The seller is required to fulfill all their obligations as stipulated under the contract by the settlement date. The seller is responsible for organising the handover, which involves providing the keys to the real estate agent for the purchaser on settlement day. They also must ensure that any work specified in the contract, particularly those relating to special conditions, is completed between the signing of the contract and settlement.

Disclosure and compliance

Before the contract is signed, the seller must make certain disclosures to prospective buyers. These disclosure obligations are legally binding and cannot be removed by a contract term. Key disclosures for real estate in Victoria include:

- Section 32 statement: This statement, usually prepared by the seller’s legal practitioner or conveyancer, must be provided to a prospective buyer before they sign the contract of sale. It includes critical disclosure documents detailing who owns the property, any registered mortgages on the property, easements on the title and a list of planning controls. All outgoings such as council rates, water service and usage charges and land lax obligations are all listed in this disclosure document. If the Section 32 statement is inaccurate or incomplete, the buyer may have a right to rescind the contract.

- Due Diligence Checklist: The seller or agent must make this checklist available to buyers, aiming to help them identify potential restrictions or obligations associated with the property.

- Expert Tip

Even with careful planning, unexpected issues can cause delays or complications before settlement.

Hiring a knowledgeable conveyancer is a critical phase in the property buying process in Victoria. Conveyancing is the legal procedure by which property is transferred from the seller to the buyer.

What Can Go Wrong After Signing? What happens after signing a contract of sale in Victoria?

Finance issues

If the buyer’s home loan application fails to gain approval, they may be protected by a clause in the contract allowing them to terminate the contract and potentially recover their deposit. Another issue that can arise is a bank valuation coming in lower than the asking price.

Contract breaches

Disputes often arise due to poorly drafted or ambiguous special conditions included in the Contract of Sale. Special conditions are additional clauses written into the contract to deal with circumstances not covered by the standard general conditions.

When a special condition is misinterpreted, disagreement may arise over whether the requirements have been satisfied. For example, a poorly worded condition regarding a buyer’s due diligence could lead to disputes about the acceptable metric for satisfaction, the right to end the contract, or who is entitled to the deposit.

How a Conveyancer Protects You After Signing?

After you sign, your conveyancer takes care of the critical next steps:

Finalising financials : Your conveyancer verifies with your lender that your mortgage is finalised and that the remainder of the purchase price is ready for transfer. They also calculate the stamp duty (a tax owed to the State Government) and organise the property transfer documents for signing.

Settlement management : They prepare a settlement statement detailing all related costs, fees, and adjustments. All outgoings related to the property are adjusted on a pro-rata basis at settlement.

Ownership management : Following settlement, they file the transfer of land with the Land Registry to formally register you as the new owner. They then provide confirmation of registration and ownership documentation..

Looking to Buy or Sell in Melbourne?

By managing complex tasks, from conducting legal searches to analysing contracts and arranging ownership transfers, a qualified conveyancer ensures your interests are protected and helps you avoid potential legal risks associated with the transaction.

Need assistance with what happens after signing a contract of sale in Victoria? For all your conveyancing needs contact us today.